The #1 Investment to Own During Trump's 2nd Term

By Graham Summers, MBA | Chief Market Strategist

I hate politics.

Politics are a full contact sport that brings out the ugliest aspects of human nature. And the political environment today is more toxic than at any other time in my lifetime.

Unfortunately for investors, the President and his/her agenda for the economy has a MAJOR impact on the markets. For those of us who want to make money from our investments, we have to address recent political events.

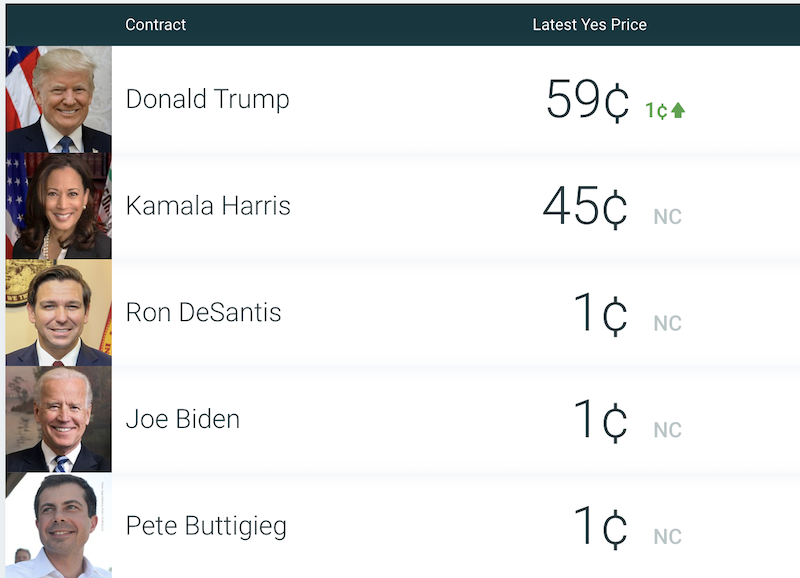

With that in mind, it is clear that Donald Trump will be the next U.S. President. That is not an opinion, it's. fact: the betting markets give Trump a ~60% chance of winning.

The #1 Investment To Own During Trump's Second Term: Bitcoin

Believe it or not, a 2nd Trump Term will also be extremely beneficial for Bitcoin.

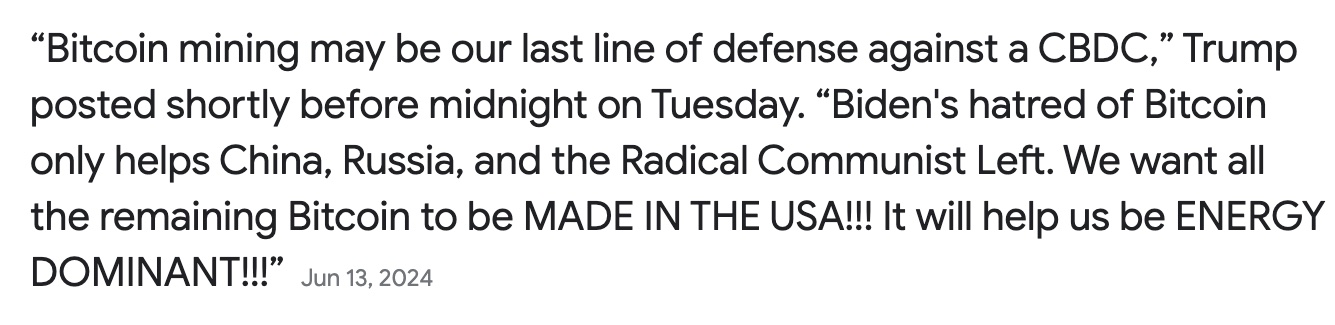

Indeed, Trump views Bitcoin and Bitcoin mining as part of his "America first" economic plan as the below quote demonstrates.

This is not just posturing...

President Trump is speaking (spoke) at a Bitcoin Conference in Nashville on July 27th. He did NOT cancel his appearance despite being shot two weeks' prior. This is a strong signal that this conference is of personal significance to Trump.

Trump won't be the member of his administration who is pro-Bitcoin, his pick for Vice President is J.D. Vance, who personally owns between $100,000 and $250,000 worth of Bitcoin as detailed by financial filings.

And finally, Elon Musk, who we know is developing a strong relationship with President Trump, is a big proponent of crypto currencies, including Bitcoin. Indeed, Tesla (TSLA) itself owns nearly $1 billion in Bitcoin.

Put simply, the President, the Vice President, and one of their biggest economic advisors are all involved in Bitcoin in some fashion.

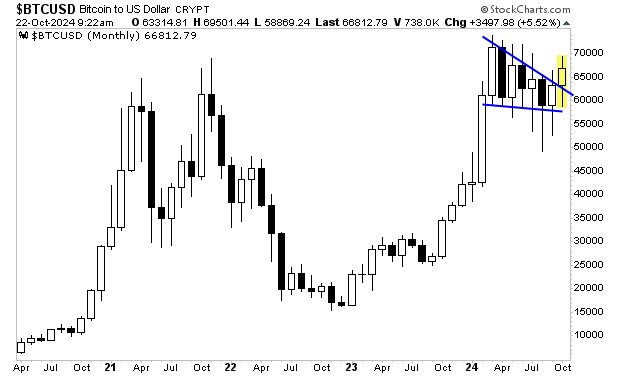

The markets are certainly anticipating a pro-Bitcoin stance from a second Trump term. Bitcoin is breaking out of a 10 month consolidation period (blue lines in the chart below).

This chart predicts Bitcoin is going over $80,000 in the next six months.

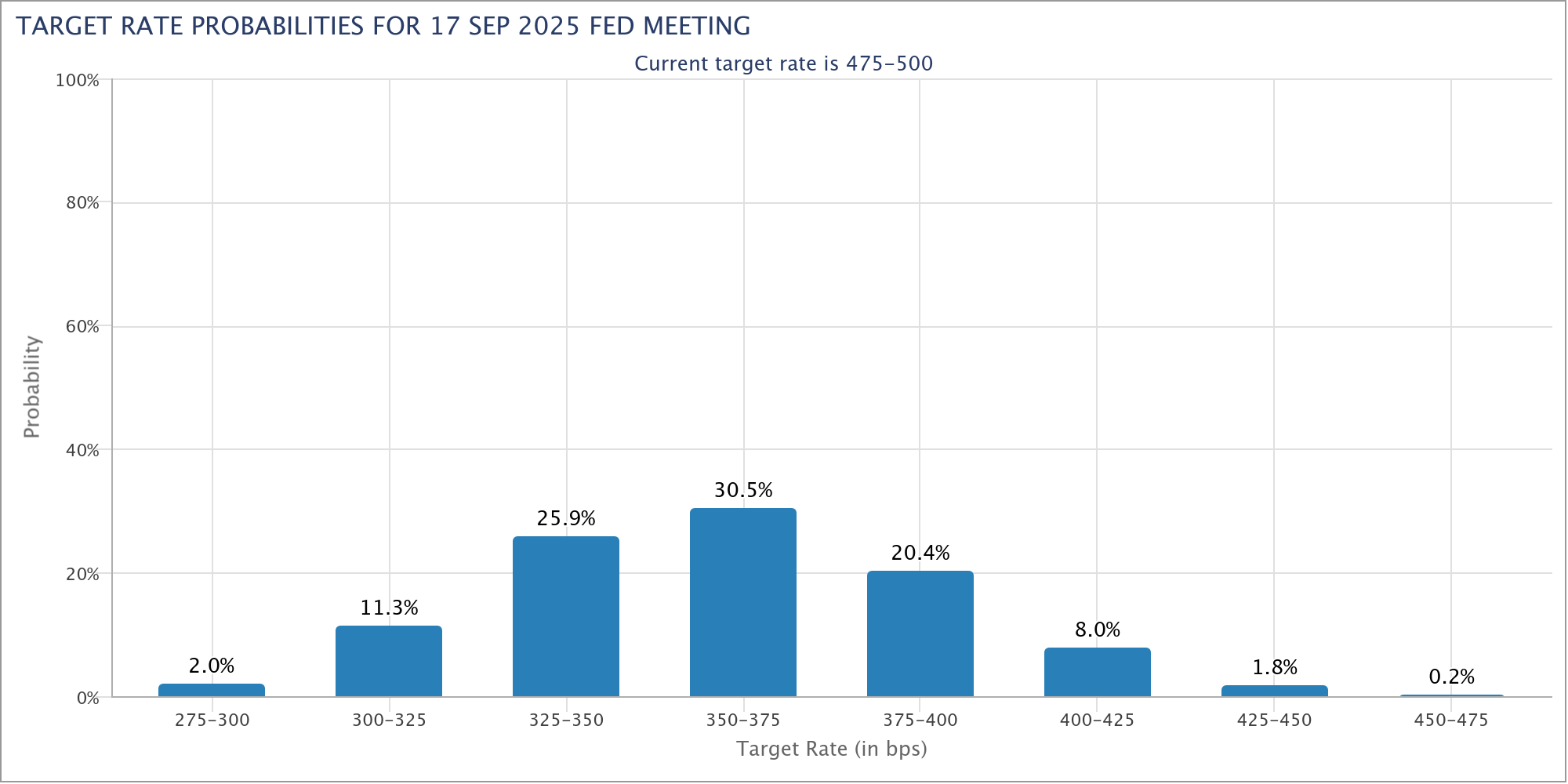

Bitcoin is fundamentally a liquidity play. And as I've outlined earlier in this report the Fed has initiated a new easing cycle. And Trump will be pushing HARD on the Fed to do more.

As I write this, the Fed Watch tool which predicts Fed actions is predicting that rates will be at 3.25%-3.75% by September of 2025. With rates at 5.0% right now, this means the market is anticipating six to to seven rate cuts of 0.25% from the Fed in the next year!

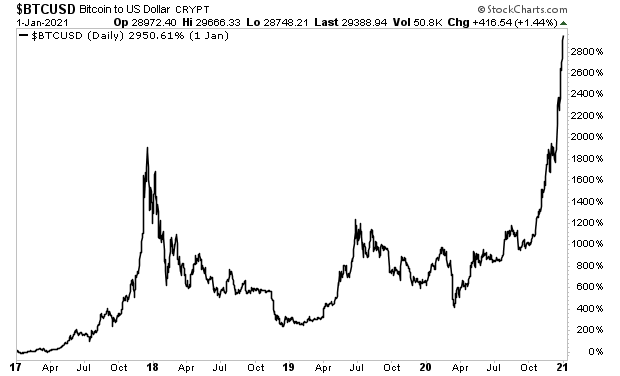

All of this benefits Bitcoin. And remember, during Trump's first Presidential term, Bitcoin rose over 2,000%! And that included the pandemic!

How to Buy Bitcoin

In terms of buying Bitcoin, I recommend using BlackRock's iShare Bitcoin Trust (IBIT).

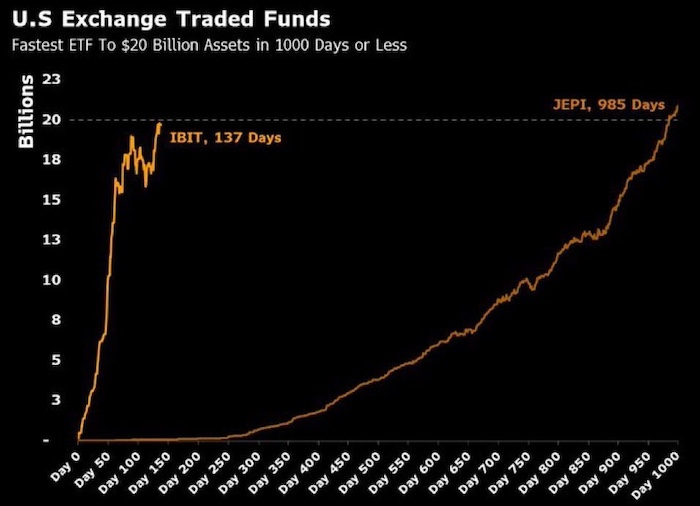

BlackRock is the world’s largest asset manager with $10 TRILLION in assets under management. It launched IBIT on January 11th 2024.

IBIT subsequently hit $20 billion in assets faster than any other ETF in history.

With IBIT, you can now buy Bitcoin easily with any major brokerage account. Prior to this, to buy Bitcoin, an investor would need to open an account with a crypto-currency specific exchange like Coinbase: a complicated process that involves keeping track of a 16-digit code to access your Bitcoin.

IBIT removes all of those issues. Its fees are lower than any other Bitcoin ETF. And it’s clearly been given the stamp of approval by the elites (again, this is BlackRock we’re talking about).

BlackRock’s Bitcoin ETF means Bitcoin is now going truly mainstream. It's the first ever highly liquid, low fee, widely available Bitcoin ETF that ANYONE can buy or sell.

As popular as it is, Bitcoin is actually owned by very few people. The entire market cap for the crypto currency is just $1 trillion.

So with IBIT, we've got a new, more liquid, easier means for investors to own Bitcoin... with the next President of the United Stated and his closest advisors all favoring Bitcoin as an investment.

This is about as perfect of a set-up as an asset class can get.

Action to Take: Buy iShares Bitcoin Trust (IBIT)

We thank you for reading and wish you all the investing success in the world!